The rental market in the United Kingdom (UK) is a dynamic industry that is impacted by a number of variables, including changes in the economy and demographics. Renting has been more and more popular due to its accessibility and flexibility, therefore it’s important to grasp the potential, problems, and current trends in this sector. We’ll examine the complex terrain of the UK rental market.

Current Trends:

Growing Rental Property Demand:

Due to a growing need for flexible living arrangements, rental property demand is rising in the UK. Statista provides an astonishing fact: “Over the past 20 years, the residential rental market has tripled”.

According to Walter Soriano, “Renting is growing in popularity as a practical and versatile housing solution, appealing to a diverse demographic from young adults to families.”

Urbanisation Is Increasing Demand for Rentals:

Due to job possibilities and changing lifestyle choices, rental property demand is highest in urban regions, especially in large cities.

As stated by Walter, “Urbanisation drives the demand for rental housing, with individuals desiring the convenience as well as liveliness of city living without the long-term commitment of homeownership.”

Build-to-Rent Sector Growth:

This industry is becoming more and more well-known, providing well-designed rental homes with contemporary facilities.

According to Walter, “Developers are recognising the appeal of professionally run rental communities, supplying tenants with an array of amenities and promoting a sense of belonging.”

Challenges:

Financial Limitations:

One of the primary issues facing the UK rental market is affordability, especially in cities with strong demand.

As observed by Walter, “Rising rental prices surpass income growth for many tenants, creating difficulties for affordability while adding to housing disparity.”

Moreover, as per a great article from Novyy, “Urban areas in the UK have been dealing with a growing home affordability crisis in recent years, making it difficult for many people and families to locate homes that meet their needs and their budgetary constraints.

A wide range of interrelated elements that individually contribute to the complicated and difficult urban housing affordability landscape underpin this dilemma. Rising real estate prices are primarily to blame for the affordability crisis.

The average UK property costs over ten times the average salary, creating a large housing expense-income discrepancy. This difference makes homeownership a distant goal for many, especially first-time buyers.”

Lack of Housing Supply:

The ongoing scarcity of available housing exacerbates the rivalry for rental homes, resulting in higher rental rates. According to Walter, “Limited housing construction and strict planning laws lead to a supply-demand asymmetry, affecting affordability and supply.”

As indicated by the Provestor, “According to data from Zoopla, rents rose by 9.7% in 2023. This growth is forecasted to continue at 5% in 2024. The rental market is still being squeezed by high demand from tenants and low supply. Due to the cost of living crisis and higher interest rates, more people are delaying buying houses and are continuing to rent. Rents are continuing to rise, outstripping wage growth, meaning that rent affordability is a concern for many.

Landlords are also being squeezed by rising costs, including mortgage interest rates. Though it’s undeniably tough out there for landlords, there are areas delivering decent yields.”

Furthermore, the following graph expressly and clearly illustrates the problem:

Source: https://www.novyy.com/knowledge-base/growing-need-for-affordable-housing-uk

Appropriately, “A lack of homes is at the heart of the affordability dilemma. The UK has a residential property shortage due to millions of unbuilt dwellings. This shortage of residential houses has raised prices, making purchasing and even renting increasingly unaffordable.”

Shifts in Regulation and Uncertainty:

Both landlords and tenants are faced with uncertainty due to ongoing regulatory changes, which include adjustments to tax laws and rental practices. Walter notes that, “Exploring changing legal frameworks as well as compliance requirements is an obstacle for both property owners and renters.”

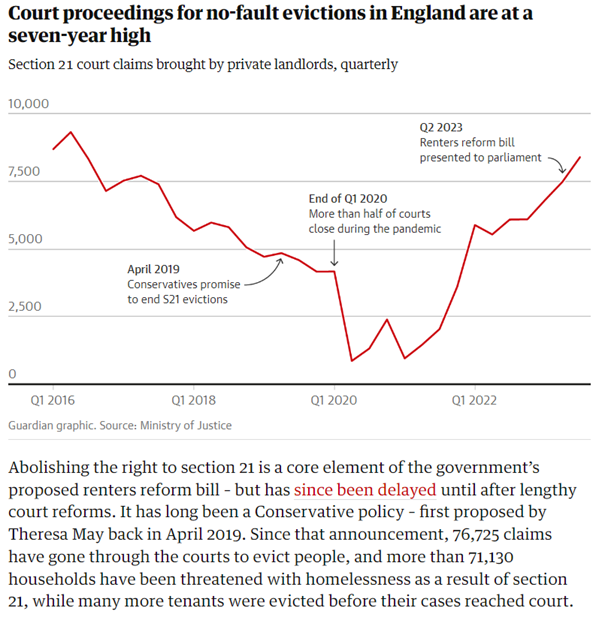

Additionally, the Guardian makes an important point by observing that “Current laws mean a lack of security while renting. One of the most pernicious aspects of England’s rental system for tenants is the dreaded section 21. This clause of the Housing Act 1988 allows landlords to issue notices to tenants evicting them without any reason.”

Source: https://www.theguardian.com/society/2023/nov/13/five-charts-explain-state-uk-rental-sector

Opportunities:

Possibility of Investment in Rental Property:

For investors looking for steady profits, the rental market in the UK offers investment prospects. As asserted by Walter, “Investing in rentals remains an appealing choice, offering the possibility of long-term capital appreciation and a consistent revenue stream.”

Not to mention, investors can also receive tax benefits from their rental investments. To validate, North East Property Investment Ltd affirms that “Overall, property investment in the UK remains an attractive option in 2024. It offers the potential for long-term growth through capital gains and rental income, while the ability to leverage tax benefits can enhance returns. Engaging in thorough research, staying updated on market trends, and seeking professional advice can help investors make informed decisions and maximise their investment potential in the real estate market. As we said at the start, we believe investing in property is always a worthwhile and profitable investment.”

Novel Approaches to Leasing:

Co-living facilities and shared ownership plans are two innovative approaches that provide potential solutions to the problem of housing affordability. Walter put it best when he stated that, “Cooperative efforts between policymakers and developers could give rise to creative rental solutions that accommodate diverse tenant requirements.”

Using Technology to Improve Property Management

Technology integration in rental property management presents chances to enhance tenant satisfaction and expedite processes. As emphasised by Walter, “Digital platforms as well as smart home technologies allow landlords to improve efficiency, improve communication, and offer a more smooth living experience for tenants.”

Conclusion:

All in all, the rental market in the UK is at a turning point; it has chances for innovation and investment but also faces issues with affordability and home supply. All parties involved—from landlords and property developers to renters looking for adequate and inexpensive housing options—need to understand these dynamics. Walter’s observations shed light on the subtleties of the rental market and offer an insightful viewpoint on the possibilities, difficulties, and trends that are currently influencing its course.